Adjustment to Exemptions Provided under Productive Input Relief (PIR) Regime

MIIC Author

Kingston, Jamaica, March 20, 2024 – Effective March 14, 2024, the Government of Jamaica (GOJ) has advised that items covered by Schedule III of the Revised Treaty of Chaguaramas (RTC) – which specifically relates to a special regime for oils and fats – will no longer be accorded duty exemption benefits on inputs or raw material under the Productive Input Relief (PIR) Regime.

The discontinuation of the granting of exemption benefits for the items on Schedule III follows from a ruling by the Caribbean Court of Justice (CCJ) to apply the established rate of duty set by the Council for Trade and Economic Development (COTED) on all imported oils, fats, and their substitutes. The Court also made it clear that the established rate of duty may be suspended by COTED where there is insufficient supply in CARICOM.

The GOJ’s withdrawal of exemption benefits to items on the Schedule III Indicative List of Goods Produced will bring Jamaica in compliance with the CCJ’s ruling and CARICOM’s Revised Treaty of Chaguaramas (RTC) rules. Importantly, affected manufacturers with approved PIR status will retain other benefits under the PIR including: i) GCT deferral on imports, ii) PIR on the Importation of equipment/machinery and spare parts, iii) PIR on Packaging and Labelling Materials, iv) 50% Discount on the Customs Administrative Fees (CAF), and (vi) Additional Stamp Duty (ASD).

The Ministry is keen to inform all affected manufacturers that the items on the indicative list may benefit from an exemption through the CET suspension regime administered by CARICOM. The Government will immediately commence the processing of CET suspension applications to avail manufacturers of the benefits under the CARICOM CET Suspension Regime for extra-regionally sourced inputs.

The Ministry of Industry, Investment & Commerce (MIIC) and the Ministry of Finance & the Public Service (MOFPS) will meet with manufacturers, industry leaders, and other key private sector stakeholders on Wednesday, March 20, 2024, to provide further clarity on the matter and commence discussions on accessing CET suspension arrangements.

Source: MIIC

Recent News

See all news

Posted on 27/02/2026

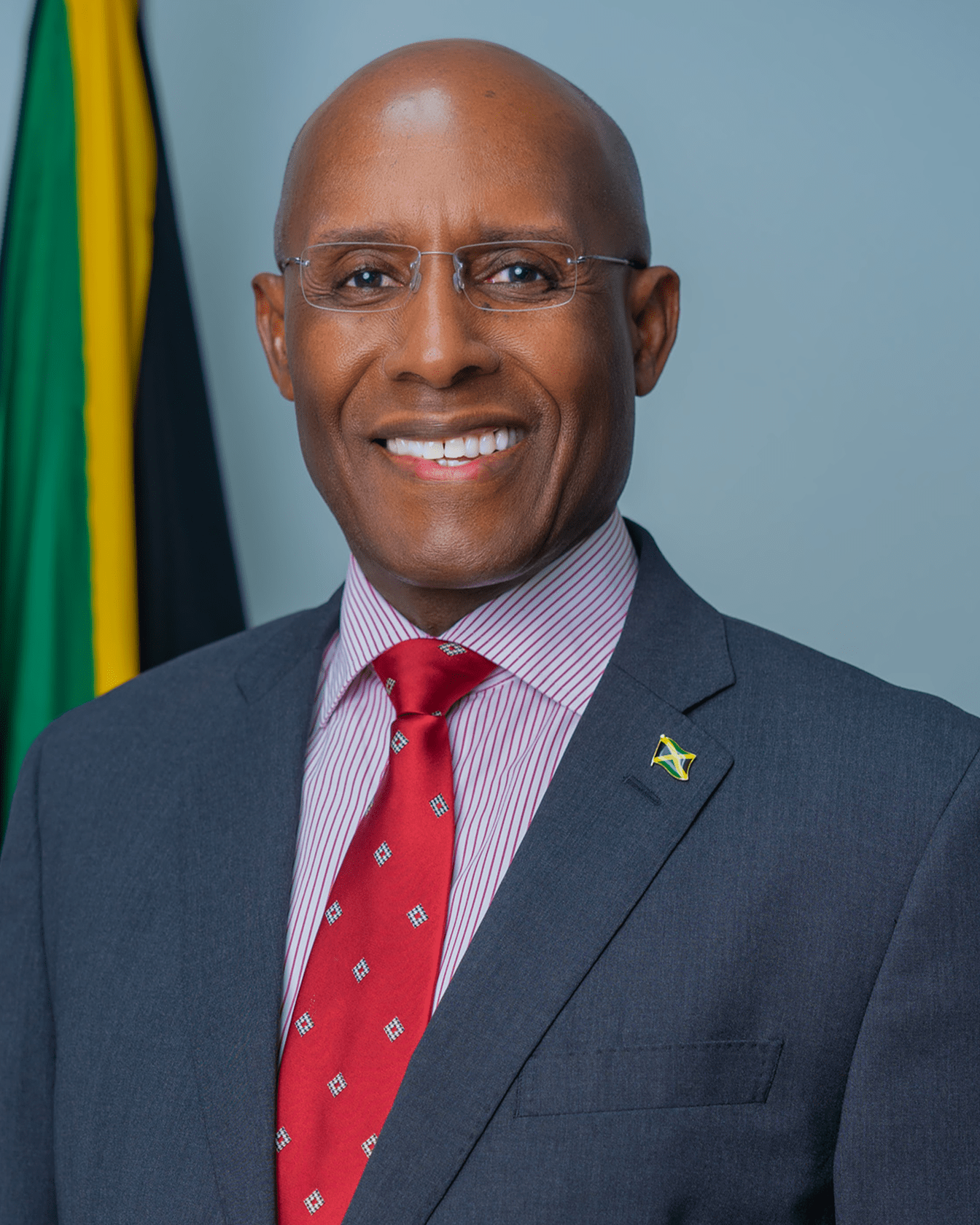

Minister Hill Leads Jamaican Delegation To Examine Best Practices At Colombia’s Leading Free Trade Zone, Zona Franca De Bogotá

Bogotá, Colombia; February 26, 2026 – Senator the Hon. Aubyn Hill, Minister of Industry, Investment and Commerce, Jamaica’s Business Ministry, led a high-level Jamaican delegation on a guided visit to Zona Franca de Bogotá, on February 25, 2...

Posted on 26/02/2026

Gov’t committed to proper functioning insolvency ecosystem, says Seiveright

KINGSTON, Jamaica — Minister of State in the Ministry of Industry, Investment and Commerce, Delano Seiveright, has been tasked with leading the Government’s drive to modernise Jamaica’s insolvency ecosystem, boost institutional efficiency and expa...

Posted on 25/02/2026

Seiveright urges youth to chase creative opportunities after meeting with entertainment entrepreneur Romeich Major

STATE minister in the Ministry of Industry, Investment, and Commerce (MIIC) Delano Seiveright has urged Jamaicans, particularly young people, to more deliberately pursue opportunities in the creative industries, arguing that entertainment, music, ...