BOLD MOVE: Gov’t pushing plan allowing MSMEs to use intellectual property as collateral for loans

MIIC Author

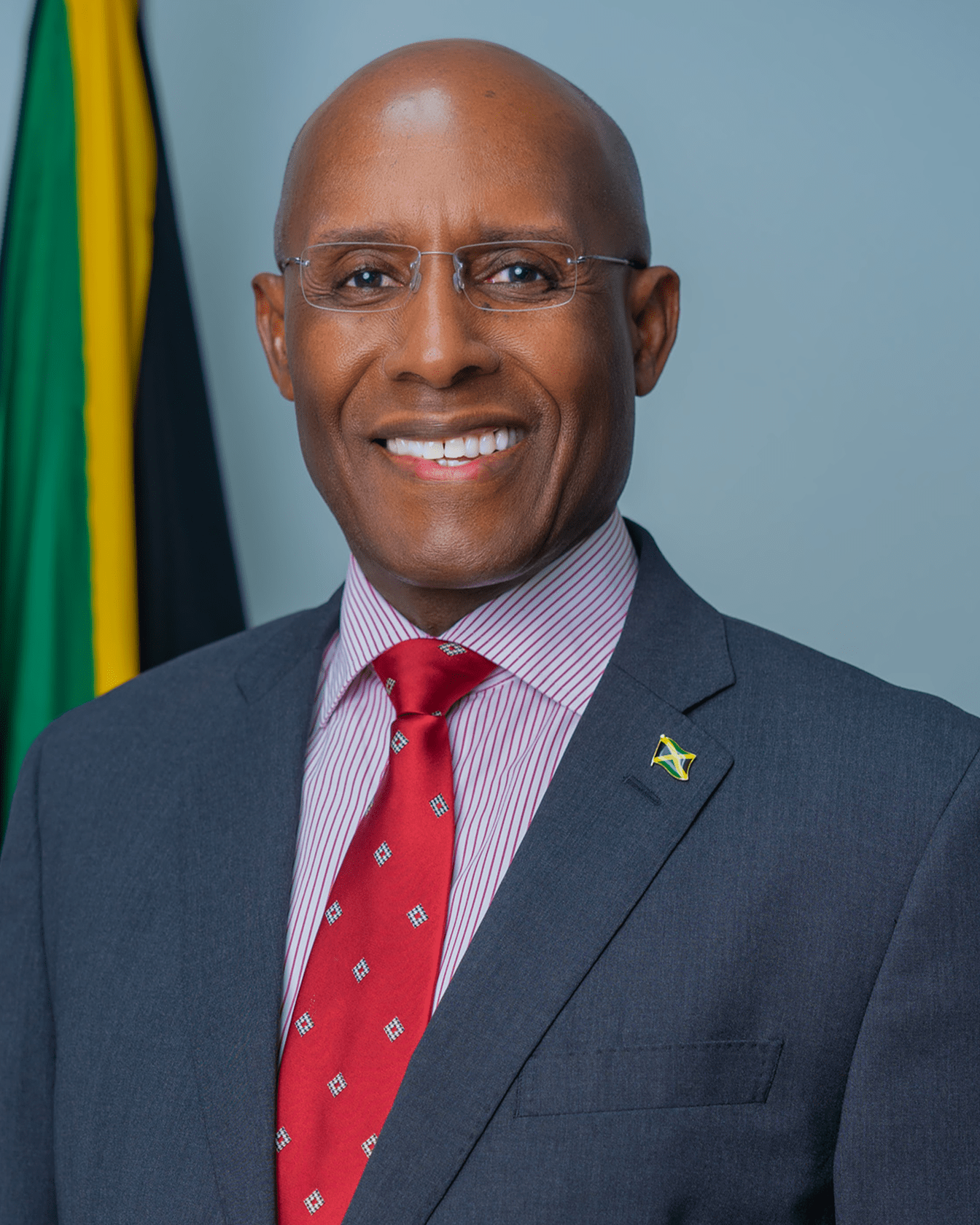

MINISTER of state in the Ministry of Industry, Investment and Commerce Dr Norman Dunn has declared that the Government has embarked on a game changing move with its decision to allow the use of intellectual property (IP) as collateral.

“This undertaking is a bold and audacious endeavour that will potentially transform the business landscape and monetise our vibrant culture,” Dunn told a recent meeting of the Jamaica Observer Press Club as he explained the plan to introduce IP-backed financing for micro, small and medium-sized enterprise (MSMEs) in Jamaica.

IP-backed financing is designed to unlock the value of intangible assets such as patents, brands, software, trade secrets and copyright, for businesses seeking financing.

According to Dunn, IP-backed financing presents a viable solution to providing capital to MSMEs which would not normally have easy access to funding.

“The value of intangible assets…will continue to increase, and Jamaica intends to be ahead of the curve. The Government has recognised the need for our MSMEs to proactively protect, manage and commercialise their intellectual property to derive maximum benefits for themselves and the economy,” said Dunn.

“The fact is, many MSMEs are sitting on a treasure trove of untapped value. The ability to use intellectual property rights or intangible assets like copyright, patents, trademarks, and other forms of collateral will transform the financial landscape completely. With more access to capital, our entrepreneurs will have new routes to trade and export within their reach,” Dunn added.

He told Observer editors and reporters that Government has long recognised the pivotal role that MSMEs play in the growth of the Jamaican economy and sought to open the door for additional financing for them through the Security Interests in Personal Property Act (SIPPA), which was passed in 2013, and the establishment of the National Collateral Registry to provide increased access to credit for MSMEs.

“The SIPPA facilitates using a more comprehensive range of collateral, outside of land in secured lending. This expansion included intellectual property.

“What businesses create and invest, when protected by intellectual property, hold tremendous value. These assets can represent over 80 per cent of the average business value. These include your business’s trade secrets, trademarks, know-how, internal systems, customers, and supplier lists. The intellectual property value of MSMEs may be closer to 90 per cent. This value is what is needed to attract financing,” Dunn added.

The state minister underscored that the culture and ingenuity of the Jamaican people have impacted the world in all areas and the island is rich in intellectual property.

“We are some of the most creative people in the world; we have to sufficiently enable our local innovators to exploit the full potential of their intellectual property. It is imperative for the Government of Jamaica to cultivate the requisite landscape to sufficiently reap the economic benefits of our culture. The recognition of the value of IP will drive innovation and competition, which boosts entrepreneurial investment, ultimately generating more income and creating jobs,” declared Dunn.

The IP-backed financing initiative is being executed by the Jamaica Intellectual Property Office (JIPO) with funding from a number of international agencies and the Government of Canada.

The British firm Inngot — which is an expert in IP asset discovery, diagnosis and valuation — is advising the Jamaican Government. Its co-founder and CEO Martin Brassell told the Observer Press Club that Jamaica is advancing on a correct path.

According to Brassell, the knowledge economy is being driven by the things that make a company different, such as its ideas and the unique knowledge that it has.

“We have to find ways to leverage those assets that we create that are knowledge-based and use them to be able to raise finance,” said Brassell.

“I am pretty confident that one day all loans are going to take a look at these intangible assets and intellectual property; they are going to have to,” added Brassell.

He argued that it all boils down to being able to say the intellectual property has real value as this is really what is driving the growth of businesses.

Source: Jamaica Observer

Recent News

See all news

Posted on 27/02/2026

Minister Hill Leads Jamaican Delegation To Examine Best Practices At Colombia’s Leading Free Trade Zone, Zona Franca De Bogotá

Bogotá, Colombia; February 26, 2026 – Senator the Hon. Aubyn Hill, Minister of Industry, Investment and Commerce, Jamaica’s Business Ministry, led a high-level Jamaican delegation on a guided visit to Zona Franca de Bogotá, on February 25, 2...

Posted on 26/02/2026

Gov’t committed to proper functioning insolvency ecosystem, says Seiveright

KINGSTON, Jamaica — Minister of State in the Ministry of Industry, Investment and Commerce, Delano Seiveright, has been tasked with leading the Government’s drive to modernise Jamaica’s insolvency ecosystem, boost institutional efficiency and expa...

Posted on 25/02/2026

Seiveright urges youth to chase creative opportunities after meeting with entertainment entrepreneur Romeich Major

STATE minister in the Ministry of Industry, Investment, and Commerce (MIIC) Delano Seiveright has urged Jamaicans, particularly young people, to more deliberately pursue opportunities in the creative industries, arguing that entertainment, music, ...