Special Economic Zones Act Amendments to Ensure International Obligations Compliance

MIIC Author

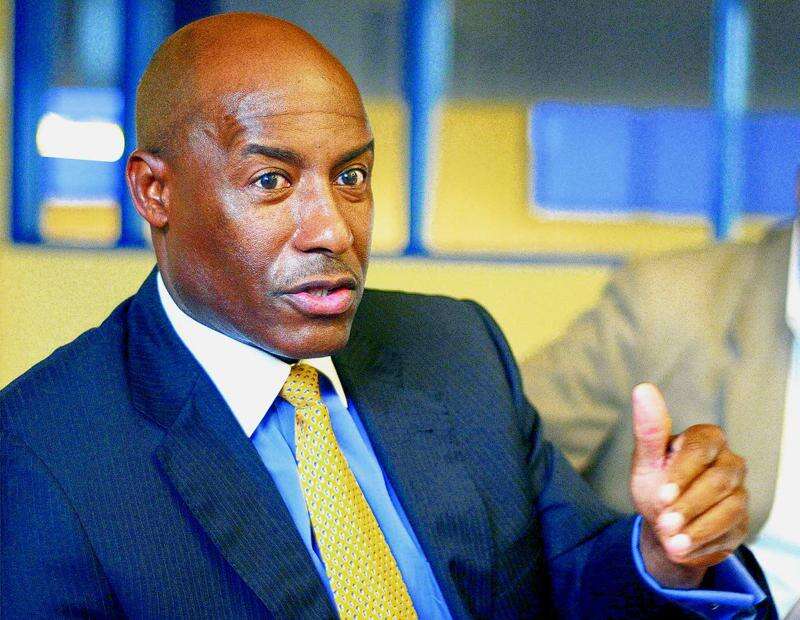

SENATOR Aubyn Hill said changes made in the Senate on Friday to the Special Economic Zones (SEZs) Act are to ensure compliance with international obligations.

The proposed amendments to the SEZ Act include not allowing entities that carry out intellectual property activities within SEZs to operate after March 31, 2023.

According to Hill, these establishments will be taken out of operation as they have been deemed to create increased potential for harm since there are no special requirements to govern these activities within the zones.

Hill said while it is believed that there are no entities in the zones which will be negatively impacted by the provision, if such an entity is discovered, the clause will allow them to operate until the stipulated time.

Further, Hill said Jamaica has opted to prohibit intellectual property activities being carried out within the zones until Jamaica creates a fulsome intellectual property regime related to activities within the zones.

Hill, who is also Minister of industry, investment and commerce, said through the amendments, Jamaica is ensuring it is conforming with international standards of tax transparency and improving the efficiency of the SEZ regime.

He noted the Organization of Economic Co-operation and Development (OECD) now requires that there are increased substantial requirements in relation to the treatment of income generating activities in SEZs to ensure that there is reduced opportunities for revenue leakage locally or shifting of profits internationally.

“The Special Economic Zone Act is therefore being amended to ensure that it meets these substance requirements as well as to address administrative issues which have been identified,” he said.

Following a review of Jamaica’s SEZ regime by the Forum on Harmful Tax Practices (FHTP) of the OECD in 2020, it was determined that modifications needed to be made to the regime in order for the SEZ to be compliant with international obligations, Hill shared.

The FHTP noted in its review that Jamaica had certain activities operating in the SEZ which would have to comply with substance requirements which stipulate that the preferential treatment of tax benefits must be given to core income generating activities undertaken by the taxpayer in the jurisdiction.

“This is usually evidenced by two specific requirements — the first is an adequate number of full-time employees which is clearly very good for the Jamaican economy; the second — adequate operational expenditure to undertake the core income earning activities. In other words, you can’t just earn income and don’t spend money you must spend money in the country,” Hill said.

Senator Hill noted that while this requirement already existing as part of the administration of the SEZ, it needs to be explicitly stated in the legislation. Therefore, he said, the amendments that are proposed will insert these substantial requirements into the legislation to provide that only companies from which core income is generated may be allowed to operate in the zone, “In other words no fly by night,” Hill stressed.

“Further, the amendments seek expressly to clarify that the rate of taxation from distribution by way of dividends paid out of profits is zero per cent. This needs to be concretised so that the administration and policy arrangement currently in effect, be compliant with what the requirements are,” Hill said.

Additionally, the senator pointed out that a few editorial corrections have been made by way of policy and administration; however, the rate had not been inserted in the Act. “This omission has caused confusion on the part of many potential investors and as such the amendments also seek to correct this error and others of this nature,” he said.

SEZs are geographically demarcated areas within countries where special tax benefits and fiscal incentives are provided to companies operating in these zones.

Source: Jamaica Observer

Recent News

See all news

Posted on 04/02/2026

E-waste disposal slows recovery of BPO sector after Melissa

Montego Bay, St James — The Global Services Association of Jamaica (GSAJ) has raised concern about delays in the full recovery of business process outsourcing (BPO) facilities damaged by Hurricane Melissa, with the slow and costly disposal of elec...

Posted on 02/02/2026

Seiveright: Corporate MoBay’s relentless pressure key to post-Melissa recovery

WESTERN BUREAU: State Minister in the Ministry of Industry Investment and Commerce Delano Seiveright, says sustained pressure from corporate Montego Bay was a critical factor in the rapid restoration of electricity and other essential services acr...

Posted on 31/01/2026

Ghana lottery authority deepens Jamaica ties with SVL visit

Reading Time: 3 minutes By Anthony Henry The Ghana National Lottery Authority (NLA) has strengthened its push for international collaboration following a high-level working visit to Supreme Ventures Limited (SVL), one of Jamaica’s leading gaming a...