JIPO upbeat banks will accept IP as loan insurance

MIIC Author

The Jamaica Intellectual Property Office (JIPO) is upbeat about the prospect of commercial banks accepting intellectual property (IP) as collateral to provide financing to micro, small and medium-sized enterprises (MSMEs).

At the most recent Jamaica Observer Press Club where the concept of IP-backed financing to access business loans was discussed, JIPO’s Project Manager Kayanne Anderson stressed that as the economy continues to evolve, all players, including commercial banks, must find new ways of doing business.

“What we have to understand in this economy is that we are actually in a disruptive economy, not a set or fixed economy. The fiat currency system is itself being disrupted. We are in a high-risk period, every decision we make has high risk, so it takes boldness, courage, and being able to push beyond,” she stated.

Anderson explained that IP assets require a patient approach, pointing to the bold investment strategies of venture capitalists with start-ups and IP owners investing in these businesses to help them grow.

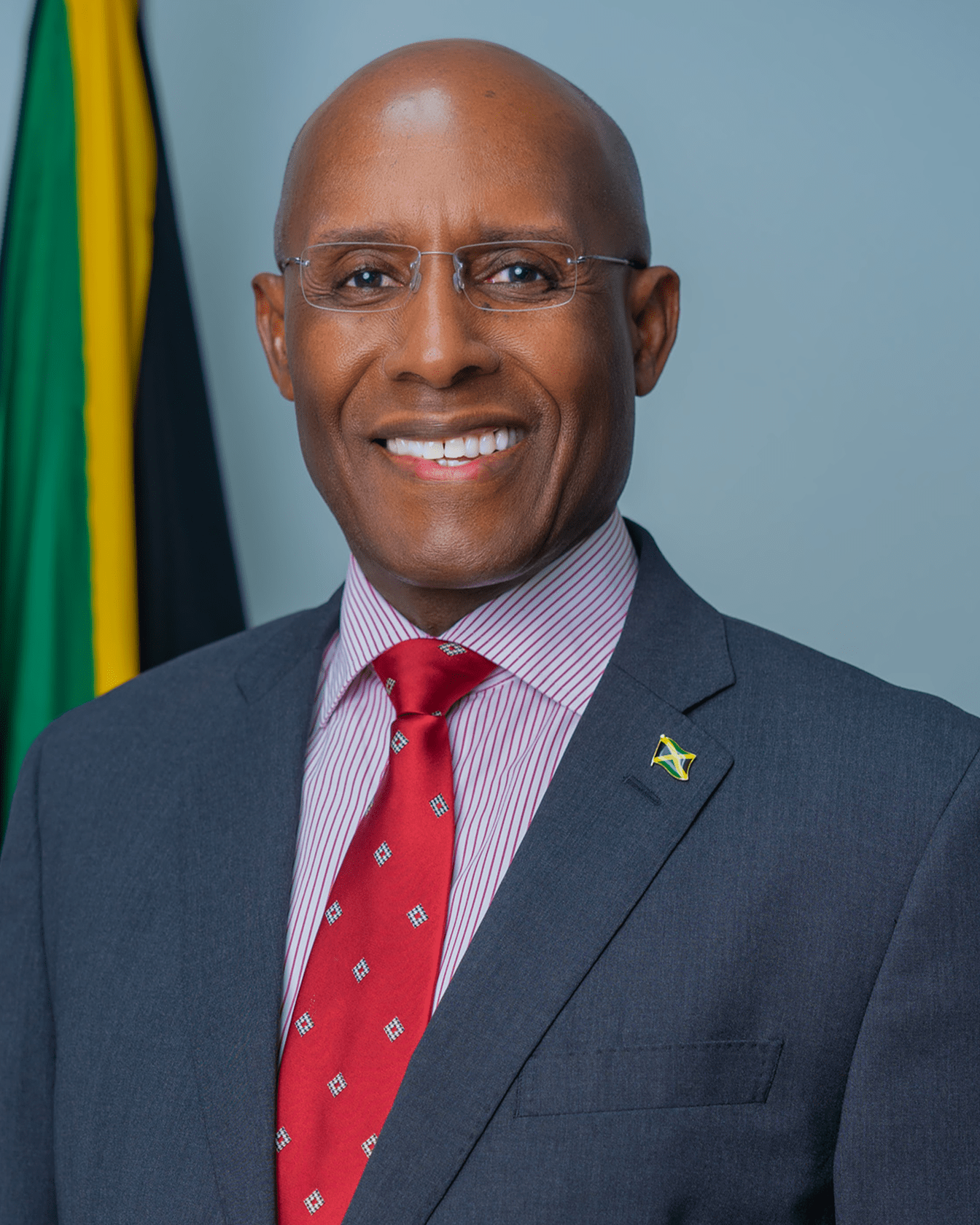

“The capital rich go after those guys. There is value there,” said Anderson, who was among a panel of experts in IP and commerce at the Press Club, which included Dr Norman Dunn, state minister for industry, investment, and commerce; Martin Brassell, chief executive officer of UK firm Inngot Limited, experts in intellectual property and intangibles, and IP and finance law; and Lilyclaire Bellamy, JIPO’s executive director.

Anderson noted that JIPO is already laying the foundation through its pilot on IP-backed financing, providing training in IP monetisation, and building awareness among banks, businesses, and assets valuers. JIPO has so far secured the commitment of two major commercial banks for the pilot, to test financial products against IP assets.

“We have reached out to the commercial banks, we have worked with the Jamaica Bankers’ Association (JBA) very closely, at the executive level — the JBA is committed to this process. We have also trained the commercial banks in valuation,” she said, noting that JIPO has trained credit risk and adjudication managers from seven commercial banks in advanced IP valuation, along with seven independent valuers, and two from the central bank.

“Building the cadre of professionals and building the understanding of how to value IP across the board [with] independent persons who can provide this as a service as well as the commercial banks themselves who are dealing with the assets when they come to them, and the central bank, which has to deal with the regulations, we found so much value from having taken that approach. It was out of that training process that all the commercial banks wanted to be involved in the pilot,” Anderson explained.

JIPO says the plan is to have companies involved in the pilot submit their loan applications to the banks by the end of December, after which the firms’ performance will be monitored. The pilot project is slated to end in March 2023.

Source: Jamaica Observer

Recent News

See all news

Posted on 27/02/2026

Minister Hill Leads Jamaican Delegation To Examine Best Practices At Colombia’s Leading Free Trade Zone, Zona Franca De Bogotá

Bogotá, Colombia; February 26, 2026 – Senator the Hon. Aubyn Hill, Minister of Industry, Investment and Commerce, Jamaica’s Business Ministry, led a high-level Jamaican delegation on a guided visit to Zona Franca de Bogotá, on February 25, 2...

Posted on 26/02/2026

Gov’t committed to proper functioning insolvency ecosystem, says Seiveright

KINGSTON, Jamaica — Minister of State in the Ministry of Industry, Investment and Commerce, Delano Seiveright, has been tasked with leading the Government’s drive to modernise Jamaica’s insolvency ecosystem, boost institutional efficiency and expa...

Posted on 25/02/2026

Seiveright urges youth to chase creative opportunities after meeting with entertainment entrepreneur Romeich Major

STATE minister in the Ministry of Industry, Investment, and Commerce (MIIC) Delano Seiveright has urged Jamaicans, particularly young people, to more deliberately pursue opportunities in the creative industries, arguing that entertainment, music, ...