JSEZA Takes Potential Investors on Site Tours

MIIC Author

The Jamaica Special Economic Zone Authority (JSEZA) is taking investors on the road with the launch of its Special Economic Zone (SEZ) Site Tours, which aim to connect potential investors with available spaces within designated SEZ areas.

The launch ceremony was held on Wednesday (February 26), at The Jamaica Pegasus hotel, in Kingston.

After the launch, potential investors were taken on a tour of areas in Montego Bay, St. James, including Mercury Wireless Limited’s commercial park/space, a 21,666 sq. ft property that specialises in creating purpose-built spaces for business process outsourcing (BPO) operators.

The company currently has approximately 2,000 sq. ft. of space available, suitable for manufacturing.

The other areas were Tekbia Limited’s commercial park/space, a 23,116 sq. ft. property, which provides facilities that also support the BPO and commercial industry; and Seven Ten Limited, which is a pharmaceutical manufacturing company, specialising in the production of Active Pharmaceutical Ingredients (APIs) from cannabis.

The total size of the facility is 10,586.52 sq. ft., with 6,000 sq. ft. of space available for sub-lease suitable for light manufacturing/warehousing.

Companies that join the Special Economic Zone (SEZ) benefit from a raft of incentives that help them position themselves as global players able to compete in a demanding economic environment.

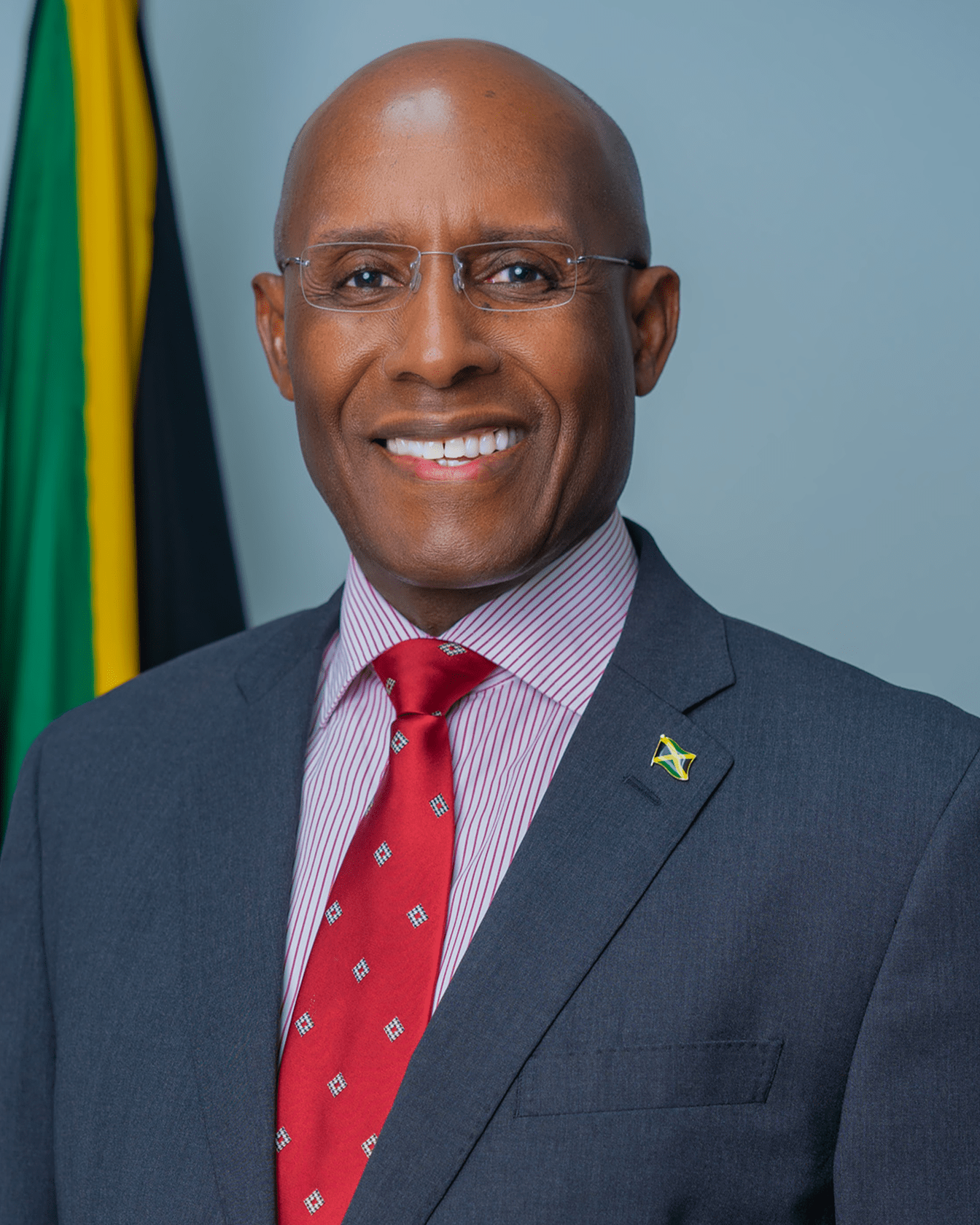

Chief Executive Officer (CEO) of the JSEZA, Kelli-Dawn Hamilton, who delivered a message at the launch from Industry, Investment and Commerce Minister, Senator the Hon. Aubyn Hill, said the tour will provide first-hand knowledge and insight into operational realities and advantages of operating within these zones.

“Jamaica’s SEZs are not simply designated spaces but serve as the cornerstone of the country’s strategic economic framework, fostering an ecosystem where businesses can thrive, expand and contribute to national prosperity,” the Minister said.

The SEZs represent a wide variety of geographically defined areas that offer simple and efficient business regulations and procedures to investors in sector-specific diversification.

“The potential offered by the SEZ regime is vast and spans a range of sectors, including logistics, manufacturing, technology and global digital services, agro processing and warehousing, cold storage – the opportunities are vast. Today, the SEZ site tour is designed to provide you with a view of the spaces available for your business expansion,” the Minister said.

Some of these benefits include corporate income tax headline rate of 12.5 per cent (possible effective rate of 7.5 per cent with the approval of additional tax credits); customs duty relief; relief from income tax on rental income; GCT Relief on all goods and services entering the Zone; employment tax credit; promotional tax credit (research and development training); capital allowance; 50 per cent reduction in stamp duty payable; and relief from transfer tax.

In addition, companies operating within the SEZ will be able to access the local market with their goods and services, provided companies pay the requisite duties and have the necessary permits and licences.

The JSEZA, an agency of the Ministry of Industry, Investment and Commerce, is responsible for facilitating the development of and promoting investments in SEZs in Jamaica.

Source: JIS

Recent News

See all news

Posted on 27/02/2026

Minister Hill Leads Jamaican Delegation To Examine Best Practices At Colombia’s Leading Free Trade Zone, Zona Franca De Bogotá

Bogotá, Colombia; February 26, 2026 – Senator the Hon. Aubyn Hill, Minister of Industry, Investment and Commerce, Jamaica’s Business Ministry, led a high-level Jamaican delegation on a guided visit to Zona Franca de Bogotá, on February 25, 2...

Posted on 26/02/2026

Gov’t committed to proper functioning insolvency ecosystem, says Seiveright

KINGSTON, Jamaica — Minister of State in the Ministry of Industry, Investment and Commerce, Delano Seiveright, has been tasked with leading the Government’s drive to modernise Jamaica’s insolvency ecosystem, boost institutional efficiency and expa...

Posted on 25/02/2026

Seiveright urges youth to chase creative opportunities after meeting with entertainment entrepreneur Romeich Major

STATE minister in the Ministry of Industry, Investment, and Commerce (MIIC) Delano Seiveright has urged Jamaicans, particularly young people, to more deliberately pursue opportunities in the creative industries, arguing that entertainment, music, ...