Minister Hill Urges Consortiums for JSE Listings

MIIC Author

Companies seeking to list on the Jamaica Stock Exchange (JSE) are being urged to form consortiums as a strategy to access capital for growth.

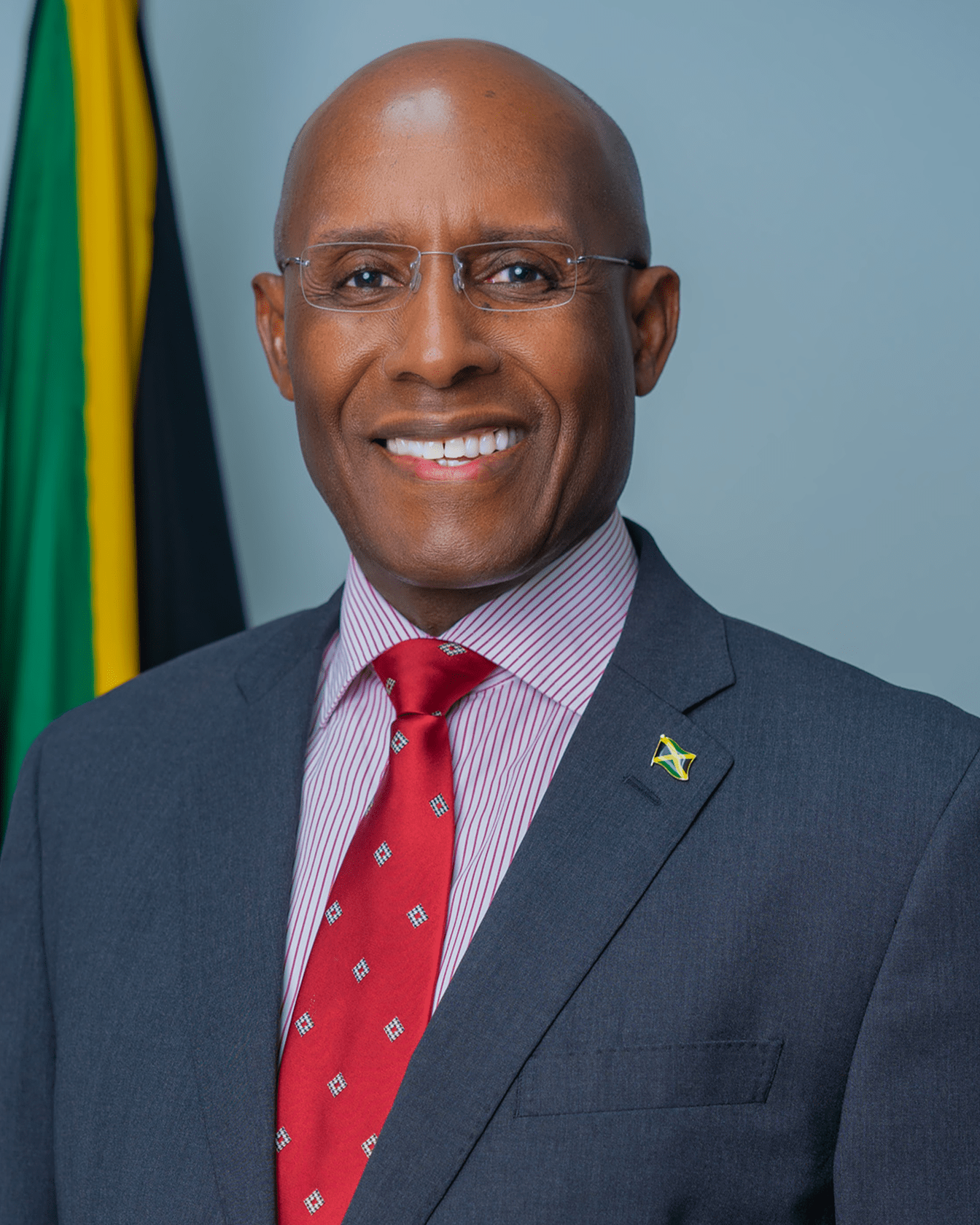

The call came from Minister of Industry, Investment and Commerce, Senator the Hon. Aubyn Hill, during his address at the JSE’s 21st Regional Investment and Capital Markets Conference, held recently at The Jamaica Pegasus hotel in New Kingston.

Minister Hill noted that as Jamaica’s business landscape evolves, consortiums will be vital to shaping the nation’s economic future.

“Get the consortiums together. Come together, make yourself into one company… try to come up with solutions as to how to put companies together. Think of how to stop being individualist and singular shareholding companies. This protects your interests,” he contended.

Senator Hill urged financial institutions to assess and prepare companies eligible for listing on the JSE.

“We want them to build their business in Jamaica, [but also] export that business. The capital is available, the frameworks are in place. The opportunities are right here in Jamaica. I invite all partners to invest in the businesses here… and join in this noble national effort to cement our political independence with a robust and sustained economic independence,” he said.

Meanwhile, Minister Hill invited stakeholders in the financial services sector to contribute to the effective use of US$2.4 billion in private capital to be mobilised for Jamaica’s post‑Hurricane Melissa reconstruction.

“That is slated to go to the private sector. We have a country that we are not just going to have to rebuild… we have a country that we are going to have to build for the future,” he emphasised.

Inter-American Development Bank (IDB) Invest, the International Finance Corporation (IFC), and the Multilateral Investment Guarantee Agency (MIGA) will drive private investment through public‑private partnership frameworks.

This initiative forms part of a broader three‑year, coordinated multilateral financing package valued at up to US$6.7 billion, designed to support Jamaica’s recovery, reconstruction, and long‑term resilience in the aftermath of Hurricane Melissa.

The three-day JSE conference, held from January 20 to 22, convened key participants in the financial services industry to exchange ideas on issues critical to the sector’s development.

It also provided a strategic forum for policymakers, business leaders, and market participants to explore strategies for expanding Jamaica’s capital markets and strengthening investor engagement.

Recent News

See all news

Posted 6 hours ago

Gov’t committed to proper functioning insolvency ecosystem, says Seiveright

KINGSTON, Jamaica — Minister of State in the Ministry of Industry, Investment and Commerce, Delano Seiveright, has been tasked with leading the Government’s drive to modernise Jamaica’s insolvency ecosystem, boost institutional efficiency and expa...

Posted on 25/02/2026

Seiveright urges youth to chase creative opportunities after meeting with entertainment entrepreneur Romeich Major

STATE minister in the Ministry of Industry, Investment, and Commerce (MIIC) Delano Seiveright has urged Jamaicans, particularly young people, to more deliberately pursue opportunities in the creative industries, arguing that entertainment, music, ...

Posted on 24/02/2026

Minister Hill To Participate In IDB-Led Technical Exchange On Special Economic Zones In Colombia

KINGSTON, Jamaica – February 24, 2026: Minister of Industry, Investment and Commerce, Jamaica’s Business Ministry, Senator the Hon. Aubyn Hill, will participate in a Technical Exchange on Best Practices in the Design and Operation of Special...