Senate Approves 2025 Regulations for Large-scale Projects Tax Relief

MIIC Author

The Large-Scale Projects (Tax Relief) (Application) Regulations, 2025, were approved in the Senate on Friday (July 4).

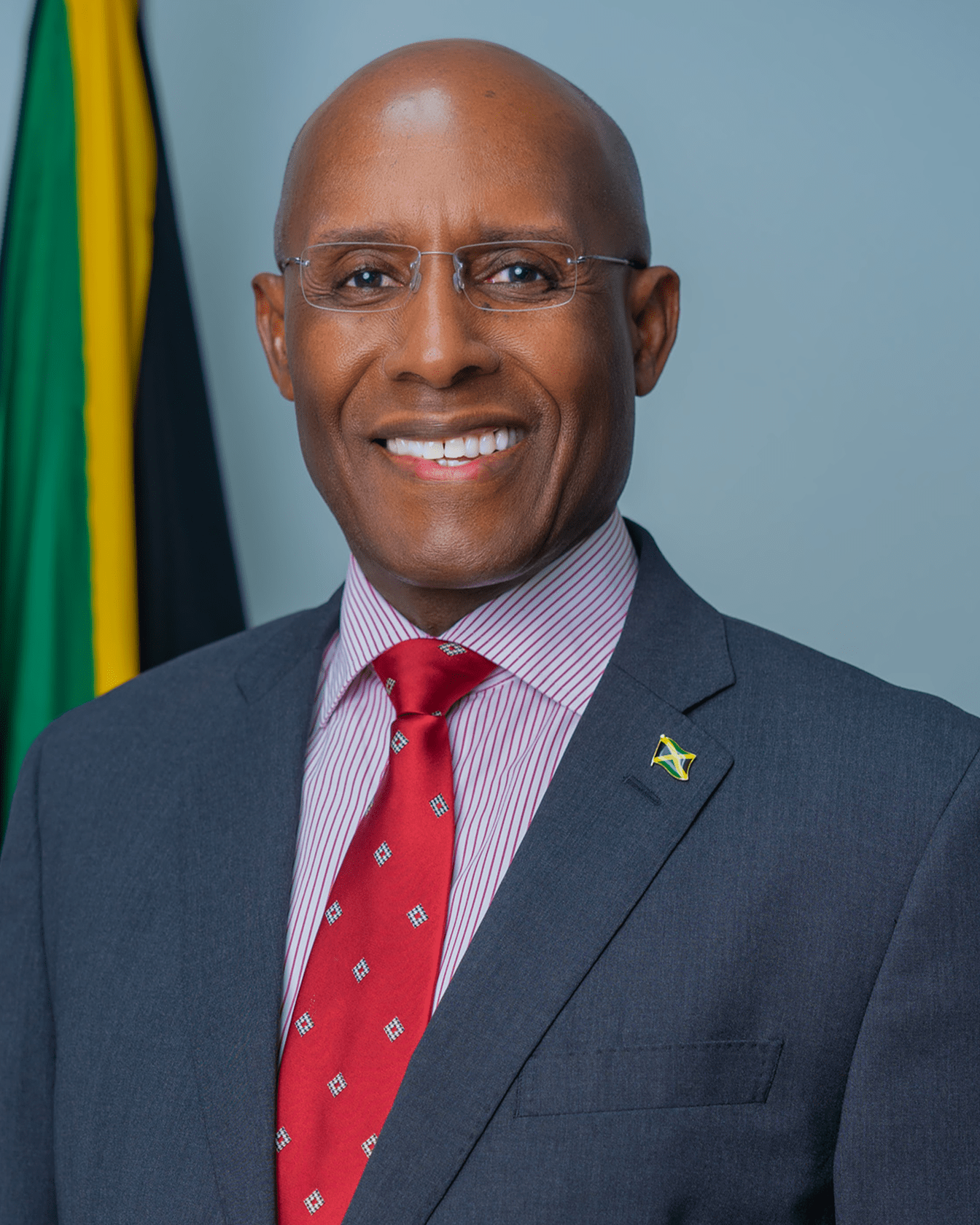

Piloting the regulations, Minister of Industry, Investment and Commerce, Senator the Hon. Aubyn Hill, said the framework was designed to clearly outline approval requirements and streamline the application process for entities seeking benefits under the Large-Scale Projects and Pioneer Industries Tax Relief Act, 2025.

“Accordingly, the proposed Regulations set out the required criteria for designation of an approved large scale project in addition to the required criteria for declaration of an approved participant. The Regulations also include the relevant forms to be utilised to apply for the benefits and stipulate the supporting documents that accompany these forms as part of the application process.

“The Regulations provide for the fees to be charged for each administrative function in the Act and the necessary reports to be provided annually by applicants who are successful in the application process,” Senator Hill said.

Highlighting aspects of the Regulations, the Minister noted that Regulation Four addresses the notification process for granting or refusing a certificate of approval following conditional approval.

“This provides timelines, 120 days for the notification of a grant or refusal of a certificate of approval,” he said.

Senator Hill noted that Regulation Five prescribes the applicable fees for major changes, amendments to the certificate of approval, and any additional investigations or reviews required during the application process.

“Number eight of the Regulations provides that any large-scale project already approved by the Government will be obligated to pay the application fees imposed by the regulations,” he added.

The Large-Scale Projects and Pioneering Industries Tax Relief Act, 2025, was passed by both Houses of Parliament in May 2025.

Senator Hill said the legislation is designed to attract large capital investments and stimulate job creation and economic growth.

The Act establishes a capital investment threshold of US$1 billion for approval under the large-scale project category; amends the definition of ‘specified incentive’ to clarify its application; expands Section Three to grant the Minister broader authority to issue fiscal incentives; introduces a provision limiting the incentive period to no more than 15 years; and allows for the carry-forward of annual incentive allotments.

Additionally, the legislation amends Section 4b to require that, before designating a project as an approved large-scale initiative, the Minister must be satisfied that there is evidence of both capital investment and job creation meeting the prescribed thresholds.

Responding to queries from Opposition Senator, Lambert Brown, regarding the implementation timeline, Senator Hill indicated that the Minister responsible will provide the information shortly.

Source: JIS

Recent News

See all news

Posted 13 hours ago

Gov’t committed to proper functioning insolvency ecosystem, says Seiveright

KINGSTON, Jamaica — Minister of State in the Ministry of Industry, Investment and Commerce, Delano Seiveright, has been tasked with leading the Government’s drive to modernise Jamaica’s insolvency ecosystem, boost institutional efficiency and expa...

Posted on 25/02/2026

Seiveright urges youth to chase creative opportunities after meeting with entertainment entrepreneur Romeich Major

STATE minister in the Ministry of Industry, Investment, and Commerce (MIIC) Delano Seiveright has urged Jamaicans, particularly young people, to more deliberately pursue opportunities in the creative industries, arguing that entertainment, music, ...

Posted on 24/02/2026

Minister Hill To Participate In IDB-Led Technical Exchange On Special Economic Zones In Colombia

KINGSTON, Jamaica – February 24, 2026: Minister of Industry, Investment and Commerce, Jamaica’s Business Ministry, Senator the Hon. Aubyn Hill, will participate in a Technical Exchange on Best Practices in the Design and Operation of Special...